tax shelter real estate definition

A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest. An investment that shields items of income or gain from payment of.

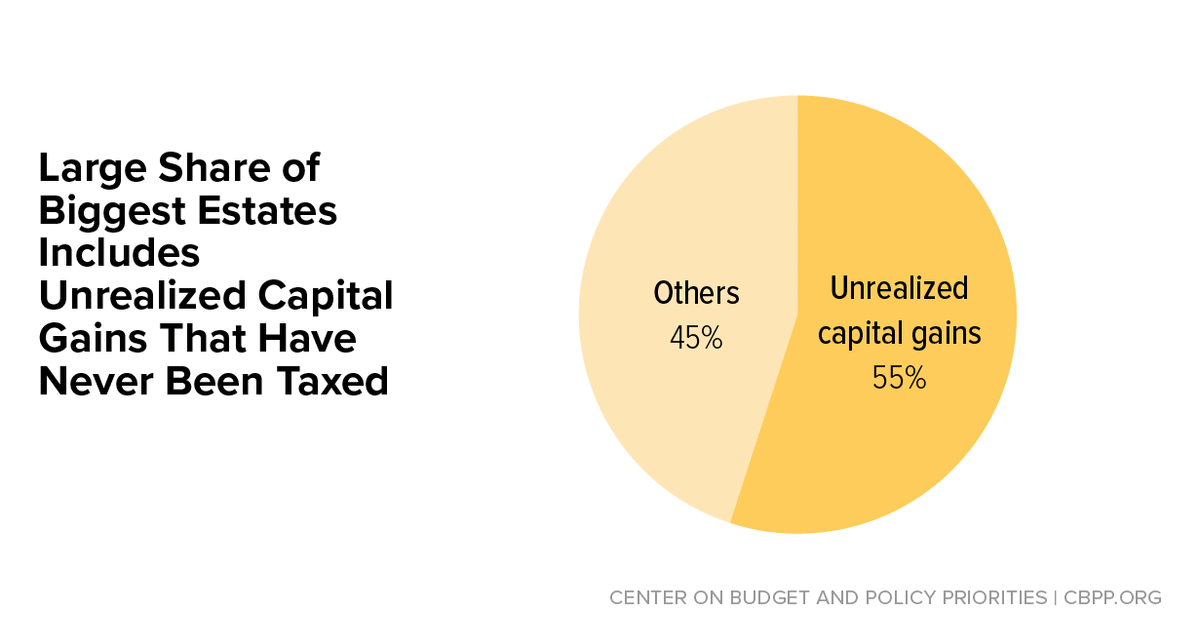

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

County Taxes and School Taxes For seniors who meet requirements 1 and 2 you may still qualify for a school tax.

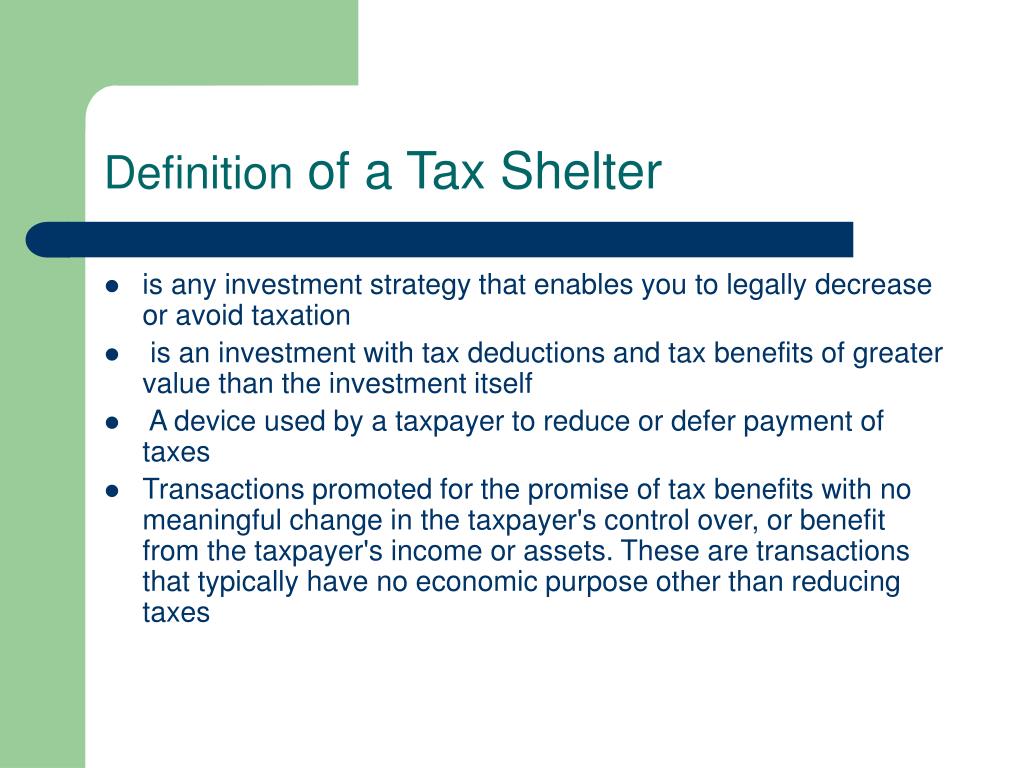

. Tax shelters are ways individuals and corporations reduce their tax liability. 448a3 prohibition defines tax shelter at. Aside from the attempts to stop tax shelters in the United States through provisions of the US.

A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. It is a legal way for individuals to.

If you are thinking about moving. Be up to date on your tax bills and watersewer bills. Tax Shelter Law and Legal Definition.

A term used to describe some tax advantages of owning real property or other investments. 23 A real estate broker includes every person certified as such by the Delaware Real Estate Commission and engaged in the real. The term tax shelter means.

A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. Studying this guide youll obtain a helpful insight into real property taxes in Hockessin and what you should take into consideration when your bill is received. A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance.

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year. Real Estate Glossary Term Tax Shelter. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any.

Tax shelters have therefore often shared an unsavory association with fraud. In most states the exercise of a limited power of appointment will not affect the rule. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake.

Tax Rate Exclusion Real Estate. You can also save on. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector.

The Delaware rule against perpetuities now applicable only to real estate has another unusual aspect. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

Passive Income Tax Rate What Investors Should Know 2022

What Is A Tax Shelter Smartasset

Tax Benefits And Limitations Of Real Estate Investments

Quirks In A U S Treaty With Malta Turn Into A Tax Play Wsj

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Navigating The Real Estate Professional Rules

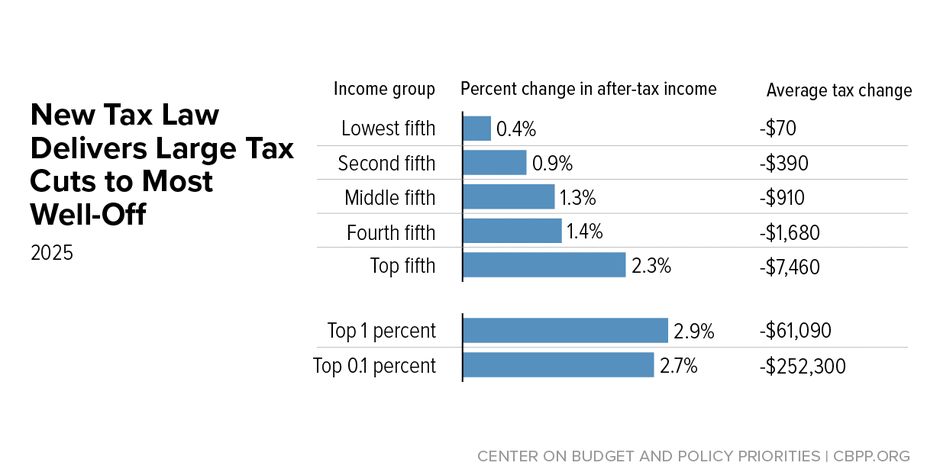

New Tax Law Is Fundamentally Flawed And Will Require Basic Restructuring Center On Budget And Policy Priorities

Ppt Tax Shelter Powerpoint Presentation Free Download Id 69636

Your Entity Could Be Considered A Tax Shelter Under The New Tax Law

Tax Shelters For High W 2 Income Every Doctor Must Read This

Definition Of Tax Shelter In Real Estate

What Is A Tax Shelter Smartasset

As Deadline Looms A Look At How Taxes Shaped Our Architecture

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)